Happy furniture to you: Pepperfry

How Pepperfry emerged as frontrunner in the tough furniture e-commerce market

1400 orders and a website crash is how Pepperfry launched in 2012

Flipkart was still fairly new, Amazon hadn’t even launched in India, and that’s when Ashish Shah & Ambareesh Murty connected while they were together at Ebay. Ambareesh was the India CEO and Ashish headed the sales operations there. They could see e-commerce growing exponentially in India and had the perfect experience to build this. So, they decided to jump ship.

“I knew the e-commerce market was coming in India. But eBay didn’t want to invest in the India business for various reasons. And I didn’t want to sit by the wayside and watch the market move on. So, I decided it was time for me to move on.” - Ambareesh on quitting eBay

They changed their LinkedIn bio to “starting up” and 25 former coworkers expressed interest in helping them build Pepperfry. This shows the equity they had built for themselves.

Back in 2012, Pepperfry wasn’t the furniture player we know it as today. They launched Pepperfry as a horizontal marketplace competing head-on with Flipkart and Snapdeal.

“When we were hunting for a good name, we asked ourselves what’s truly Indian? We came up with spices. Hence pepper. It’s truly Indian! We added fry to bring the tadka element”

Because of their former experience at eBay, they were able to crack affiliate marketing from Day 1. In fact, they received ~1400 orders within a few hours of launching. As they weren’t expecting this, the website crashed. They were only expecting 30-40 orders in the first few days. But with this, their aspirations multiplied.

Happy furniture to you

Within a year, Pepperfry realized the horizontal experiment was not at all sustainable. They were competing with entrenched horizontal players like Flipkart and hence had to burn a lot to acquire customers. According to their website from 2011, they were offering up to Rs 4000 worth of credits to shop from them.

Unlike other platforms, they were the only ones to do Furniture. Being the first mover, >65% of their revenue was coming from this category. Due to high order value (~Rs 10,000 versus Rs 400 in fashion) and low competition, this segment was a lot more profitable for them.

In 2013, They took a leap of faith and pivoted to exclusively doing home and furnishing. In a single day, they lost ~35% of their business. They knew this focus will pay dividends soon.

It wasn’t easy to convince customers to buy big pieces of furniture online. To make acquisition easier, they launched a few low-value products to build trust in their brand. Bedsheets became one of their highest selling products. ~45% of these customers returned to make higher-value purchases, validating the hypothesis.

Operating in a large but very fragmented market

Furniture is a >$30 Bn market in India and growing really fast, expected to be $60 Bn in 2030. However, it is highly fragmented with the top 5 brands in India owing less than 5% share. More than 90% of the category is unorganized.

As a result, when Pepperfry moved in, the market had almost no brands. This meant that they, as a retailer, bore the burden of building trust (compared to the brands in other categories like Electronics and Fashion)

Whatever it takes to build trust

Building trust with customers became core to Pepperfry's mission. Unlike other players, they decided to be a managed marketplace (fancy term for a lot more hands-on marketplace)

Their staff visits the seller’s location to vet the images versus the actual product

Merchandising (photographs and listing) is controlled by them

Quality checks are done in the warehouse prior to shipping to the end consumer

However, they knew most people still preferred to touch and “knock” the wood before purchase.

Thus Pepperfry opened its first studio in 2014 in Mumbai.

They wanted to be wherever their customers wanted them to be. They had a curated list of furniture from their online store in their studio along with design consultants. Personally catering to the customers and delivering their orders directly to their homes that early on gave Pepperfry a massive advantage over its competitors that were still only online. They even had a much higher 30-35K AOV in stores compared to online. They now have 60 stores across the country.

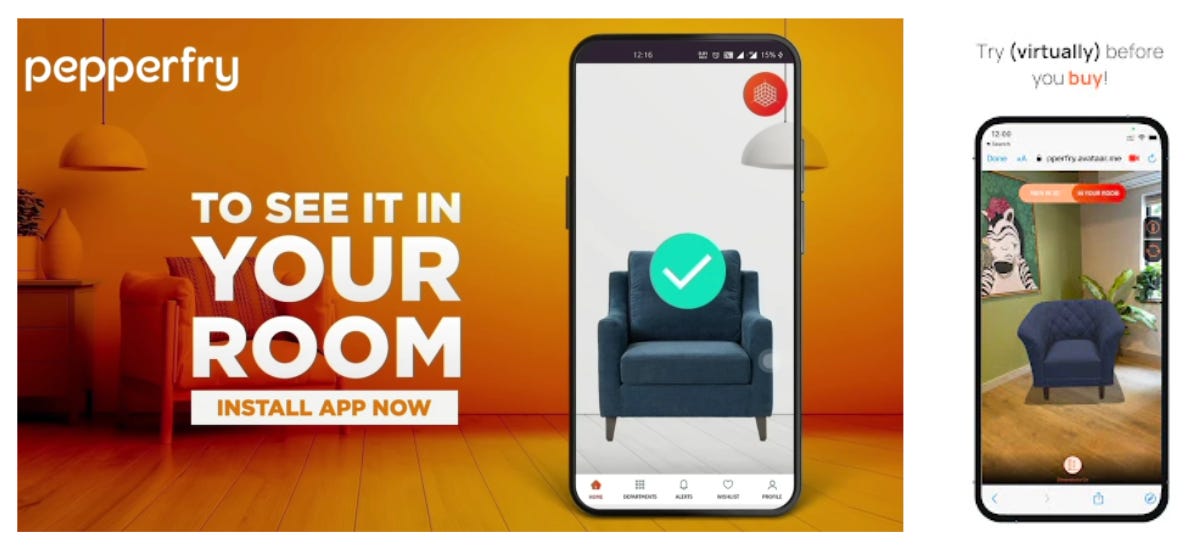

While offline experiments were working well, they were really expensive to scale. They decided to invest heavily in augmented reality, so customers could virtually place the furniture in their homes.

Owned the end to end supply chain

Delivery is still a concern for e-commerce firms in 2022, and it was significantly worse in 2012. With companies like Flipkart and FirstCry establishing their own logistics networks, it was only a matter of time before Pepperfry followed suit.

“Courier partners won’t take our deliveries to the top/respective floor for the customer; they would just leave it at the building’s basement. This could even damage the furniture. Creating a really bad experience for the customer”

In 2013 itself, they got 10 trucks to control the furniture delivery experience. This became a key differentiator for Pepperfry.

By 2019, Pepperfry had 400 trucks making them the largest B2C big-box delivery service in India.

Similarly, on the supply side, they worked closely with several small and medium-sized merchants across North India. Their feet on street staff enabled with technology tools allowed them to achieve an aspirational level of standardization.

“Teak finish could mean slightly different for various suppliers. But a bed and a side table of different finishes don’t work for a customer. We ensure this never happens”

A business model built for growth

They have a strong business with Gross Margins being 55%+ and post-marketing Contribution Margin at 20%+. All of this while owning minimal inventory due to their pure marketplace model.

Their strong margins are a result of a series of private labels they launched over time. They now see ~50% of their revenue coming from private labels.

Competitors VS PepperFry

Throughout its journey, Pepperfry has been compared to Sequoia and SAIF-backed Urban Ladder. Unlike Pepperfry, Urban Ladder was building a brand and not a marketplace. They were selling premium furniture and home furnishing (AOV of ~20K).

With strong initial fundraises and marketing push, they started out ahead of Pepperfry. In FY2014, Urban Ladder did Rs 12 Cr of revenue versus Rs 7.6 Cr for Pepperfry.

However, over time Urban Ladder’s premium brand approach led to growth plateauing. Pepperfry operated at lower prices and had a massive collection of 80K products (compared to 4K for Urban Ladder). This helped them target the mass-premium looking for variety, quality, and value each.

Over time, international players like IKEA and horizontals like Flipkart and Amazon also entered the space. Pepperfry’s early bets on in-house logistics and offline expansion played out strongly, helping them take a pole position in the online furniture market segment.

What’s next for Pepperfry

Pepperfry has a whopping 6,50,000 customer base spread across 12 countries. They intend to grow their stores from 60 to 200 stores this year. Until last year, offline stores accounted for 30% of their sales, which they hope to boost to 40% with these new locations. While they're at it, they want to expand their private label into new categories and go into modular furniture.

They have also been focusing on tech for the past few years and are bullish on the metaverse.

“Imagine a Pepperfry Studio where everything is virtual, without a single piece of furniture in the Studio. We’re working to make it real”

While at the beginning of 2021 they announced that they are 15 months away from going public and becoming a unicorn, looks like they have put those plans on hold for now and are now focusing on high growth and expansion over profitability.