Licious: A Supply Chain Like No Other In The Meat Industry

Creating a non-vegetarian niche in a country that has the highest share of vegetarians in the world

India and meat consumption have a complicated relationship, but in terms of numbers the National Health Family Survey suggests that 70% of the women and 78% of the men in India consume some form of meat, and the annual consumption of poultry meat rose to more than 3.9mn metric tonnes in 2020. However, more than 95% of the fresh meat & seafood industry in India is unorganized and the thought of a meat market usually brings to mind images of local, filthy markets that have an unbearable stench.

In a country where meat procurement solely meant local markets, Licious was created based on a series of consumer insights

With the aim of changing the way Indians consume meat, Abhay Hanjura, a former employee in the BFSI sector, and Vivek Gupta a chartered accountant from Chandigarh, came together in Bengaluru to create Licious.

Taken from the word ‘delicious’, ‘Licious’ was decided upon as the name for the brand.

“We wanted to name our company something that appeals to people’s emotions. Our intention was to be a complete meat brand.”

They designed their brand proposition through a series of consumer insights that they observed. Firstly, as there was a cultural stigma associated with the meat business, “Nobody wanted to make it their business and, hence, there was absolutely nothing that existed,” Abhay Hanjura said. Secondly, the meat and seafood market was not particularly focused on the consumers they catered to. Hence there was no development when it came to quality or supply.

“One of our friends from the US told us that he would turn vegetarian whenever he came to India! During our research we understood that the main solution to the problem was improving the quality of the meat, not just delivery systems,” adds Vivek.

A first-mover in the farm-to-fresh business model for the meat industry, Licious designed a robust supply chain

To design their business model, they went through initial preliminary research that included visits to poultry farms to understand how their supply chain worked, consulting food industry experts, and a comprehensive analysis of the industry statistics. This even included visiting evolved meat-eating markets like China, Japan, and Korea to understand the process of setting up cold chains and processing centers. With these insights, they narrowed down three aspects of their business.

“We believe that the three pillars that will help us stand out from the crowd are our product, our platform experience, and the delivery experience. We are the only D2C player that processes the meat and poultry we sell. That in itself gives us greater control over the product in terms of quality.”

Licious works on a farm-to-fork business model. From procurement, processing, and storage to delivery, the company handles the entire supply chain. Taking a cue from Amul, Licious has eliminated the middlemen to take control of all their processes.

"I strongly believe that what Amul did for milk, Licious will do for animal husbandry" Abhay projects.

According to Licious, 50% of their meat comes from their own farms, with the rest coming from other farms where they’ve deployed sourcing teams that train farmers to develop biosecure farms which ensure zero contamination. They also conduct regular quality checks at their partner farms to ensure that the birds are not pumped with antibiotics and that they are allowed a stipulated growth period. From the farms, the poultry is taken to their processing and delivery centers. Although they started with a processing center in Bengaluru in 2015, they slowly expanded operations to Mumbai, Delhi, and Hyderabad.

To remove the stigma around meat, Licious sells and transports meat in leak-proof pouches and containers, instead of black plastic bags. Currently, Licious supplies meat in 14 cities in India- Bengaluru, Hyderabad, NCR, Chandigarh, Mumbai, Pune, Chennai, Jaipur, Coimbatore, Kochi, Puducherry, Vizag, Vijayawada, and Kolkata. They are looking to expand operations and set up offline experience stores all across the country.

At every step of their supply chain, Licious ensures that the meat is fresh and kept at a temperature between 0°-4°, which is the ideal temperature to store meat. Since they don’t outsource any operation, they have 90+ delivery centers that cater to the 14 cities they currently have a presence.

“The fact that we do not outsource any of the job roles guarantees greater accountability and a sense of ownership across the organization. All Licious products undergo more than 150 quality checks at various stages of sourcing and processing,” says Hanjura.

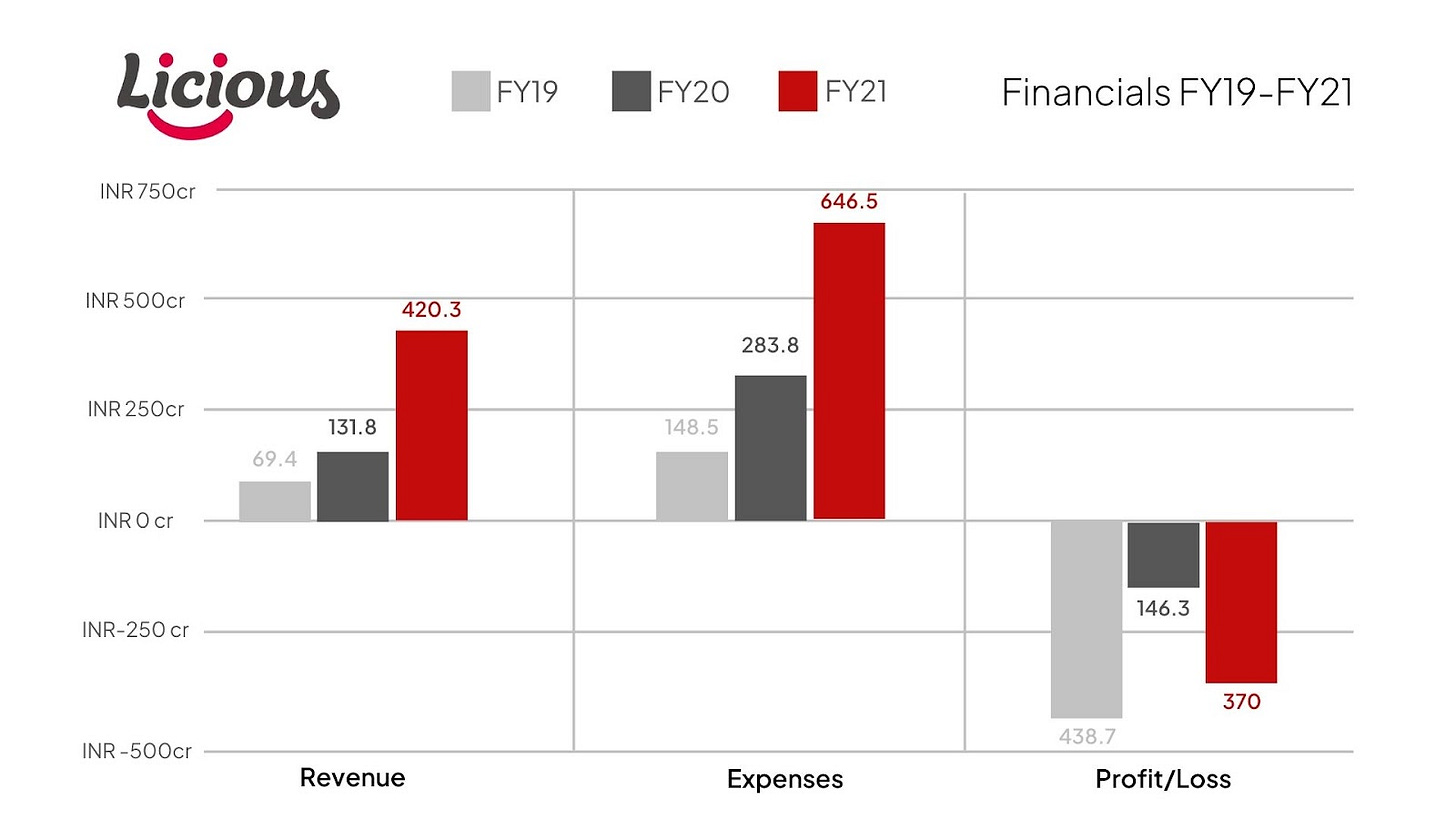

With a total amount of $488.5mn in funding, Licious is one of the highest valued D2C startups in India, with a valuation estimated at around $2bn. The company’s valuation had crossed the $1bn mark in October 2021, with a previous round of funding led by IIFL AMC’s Late Stage Tech Fund, to become the first unicorn startup in the D2C segment, and the 29th unicorn of India in 2021.

Licious manages to predict consumer demand and cut down on wastage by harnessing the power of technology

The success of Licious’ smooth supply chain and customization hinges on its use of technology. They’ve been using advanced statistical modeling over a long period of time to understand consumer behavior and stay ahead of unexpected changes in demand to reduce wastage. These predictive algorithms have helped them cut down their wastage from 40% to 3%, a massive feat in the fresh meat and seafood industry.

"From demand planning to procurement planning to manufacturing plan to logistics plan – everything is done automatically today via algorithms. That is the only way for us to do it consistently in a manner that makes sense and is predictable," Verma notifies.

To cater to areas in which they do not have a processing center, their Ai-based demand-supply algorithm predicts the demand, and items are shipped accordingly within two days of procurement.

Their entire supply chain is IoT enabled, and they collect massive amounts of data that also includes temperature breaches, the history of the animals they use, their customers, and products.

“We get tons of data from our IoT devices, but we are not interested in storing a humongous amount of data. Cloud enables us to on-demand store and analyze many data points and discard it which is not needed. What we are interested in are the exceptions. Exceptions are important for us and not the regular stream of data," explains Verma.

Licious utilizes proprietary AI technology to ensure precise and clean meat cuts and also trains its farmers to adapt to new-age technology for consistent delivery of product quality. They are working with geocoding API and Google Maps to strengthen its logistics and optimize delivery operations by tracking farm pickups, calculating delivery times, and mapping out courier routes.

Keeping their marketing strategy fairly simple, they tailor it to the needs and preferences of each city

While Licious saw a growth in all their fresh meat product categories, it's their ready-to-eat products that significantly contributed to their revenue. New launches like their tandoori and kebab ranges and chicken spreads emerged very popular, and Licious saw 6x growth between 2021 and 2022. The average basket size grew by 30% to ₹700 and they enjoy a repeat purchase rate of 90%. During the lockdown period as people were hesitant to buy meat from markets, they resorted to online options, and Licious saw a massive surge in orders as consumers found them to be trustworthy and reliable.

Licious tailor-made their marketing strategies according to the city they were in. Instead of merely dubbing their Hindi ads, they created ads in different languages prevalent in the area, with celebrities who are popular there. Around 75% of new customer acquisitions happened via word-of-mouth, after conducting tasting sessions in apartment buildings. Getting families and friends involved went a long way in terms of customer loyalty in the future.

They also invested in below-the-line activations to keep their consumers engaged, as well as digital marketing. Campaigns and advertisements like the #FasterChef campaign, which was focused on good food and the joy of sharing, and collaborations with celebrities from the Bollywood and Tollywood industries helped with brand awareness.

They also launched a relationship module called ‘Priority Desk’ for frequent consumers, where they have access to a relationship manager for any issues starting from the placement of the order to the delivery. This has given them massive returns in terms of customer satisfaction. Their brand USP message “Pay What You’ll Really Eat, and Love” highlights the Licious practice of weighing the meat after cutting and cleaning it, unlike other meat markets where they cut and clean the meat only after weighing it first.

For a company riding solo in their niche, threats of new entrants and competition are ever looming

Licious faced a couple of roadblocks along the way, starting from its inception. Abhay Hanjura, who hailed from a family of Kashmiri pandits, faced a lot of resistance to his idea of a meat startup. Once the company was set up, they had to shut operations on the very first day, due to delays with orders. After taking a break to work on their supply chain, they relaunched within a month. Even today, there is a constant threat of livestock infections, meat substitutes, the rise of new players and intense competition in the meat market, and the challenge of changing the consumer preference of purchasing from their local meat shop.

Although it seems like Licious seems to have everything going for them, they cannot ignore a few rising challenges such as the rise in competition and changing consumer mindsets about online meat purchases. Bengaluru-based FreshToHome, Delhi-NCR-based Zappfresh, Chennai-based TenderCuts, and other players like Venky’s, Nandu’s, and Suguna Foods, which have a loyal offline following are also working on their online presence. Bigger players like Amazon, Big Basket, and JioMart are also venturing into the meat-and-fish space. For a brand that keeps innovation and evolution at the core of what they do, we are yet to see how they deal with a challenge to its market monopoly.