The Honest Co.: A Story Of Living Up To Brand Expectations

A Hollywood actor, a disruptive proposition and a unicorn status. Recipe for success?

Amongst the many changes in consumer behavior over the last decade, a significant shift was observed in the level of consciousness regarding the ingredients/materials used in the products, specifically amongst millennial and Gen Z consumers. Health and well-being are now more than just a trend and have become a lifestyle choice. There is increasing demand for transparency and traceability, and this need prompted Jessica Alba to start The Honest Co.

A mom’s latent need to provide a child with quality products is what prompted Jessica Alba to start a brand

Jessica Alba is a Hollywood actor who is an industry veteran with over 20 years of experience. She kicked off her career at the young age of 13 and has starred in movies such as Fantastic Four: Rise of the Silver Surfer, Machete, and Spy Kids: All the Time in the World. In 2008, after a baby shower for her first child, she washed some of the gifts with a detergent that caused her to break out in rashes. The experience opened her eyes to the effect detergents might have on a baby’s more sensitive skin, and she spent the next couple of years researching the ingredients in everyday consumer goods. The results were worrying. From petrochemicals to formaldehyde and flame retardants, the list contained a host of toxic components. In 2011, she even traveled to Washington DC to advocate for changes to the Toxic Substances Control Act (1976) which permitted 80,000 chemicals to be used in household items without being tested.

Eventually, she decided to take a shot at it herself, and The Honest Co. was born. Her mission was clear: “I wanted safe and effective consumer products that were beautifully designed, accessibly priced, and easy to get.” The company started with three other co-founders- Brian Lee, Christopher Gavigan, and Sean Kane who were all startup entrepreneurs with the same passion for creating safer products.

A champion of the subscription model in the consumer goods category, they identified consumer needs and responded swiftly

Their first task was to raise money. When it comes to consumer goods, the impression amongst venture capitalists was a certain amount of skepticism around its level of scalability, the risk involved, and the high competition, all of which have an effect on their returns. So to garner interest from VCs they emphasized their product differentiation in terms of creating safe, non-toxic, chemical-free consumer goods, and specifically targeted the diaper industry. Co-founder Brian Lee stated, "That's the only thing we pitched, it was very strategic as we knew that was the way into your home."

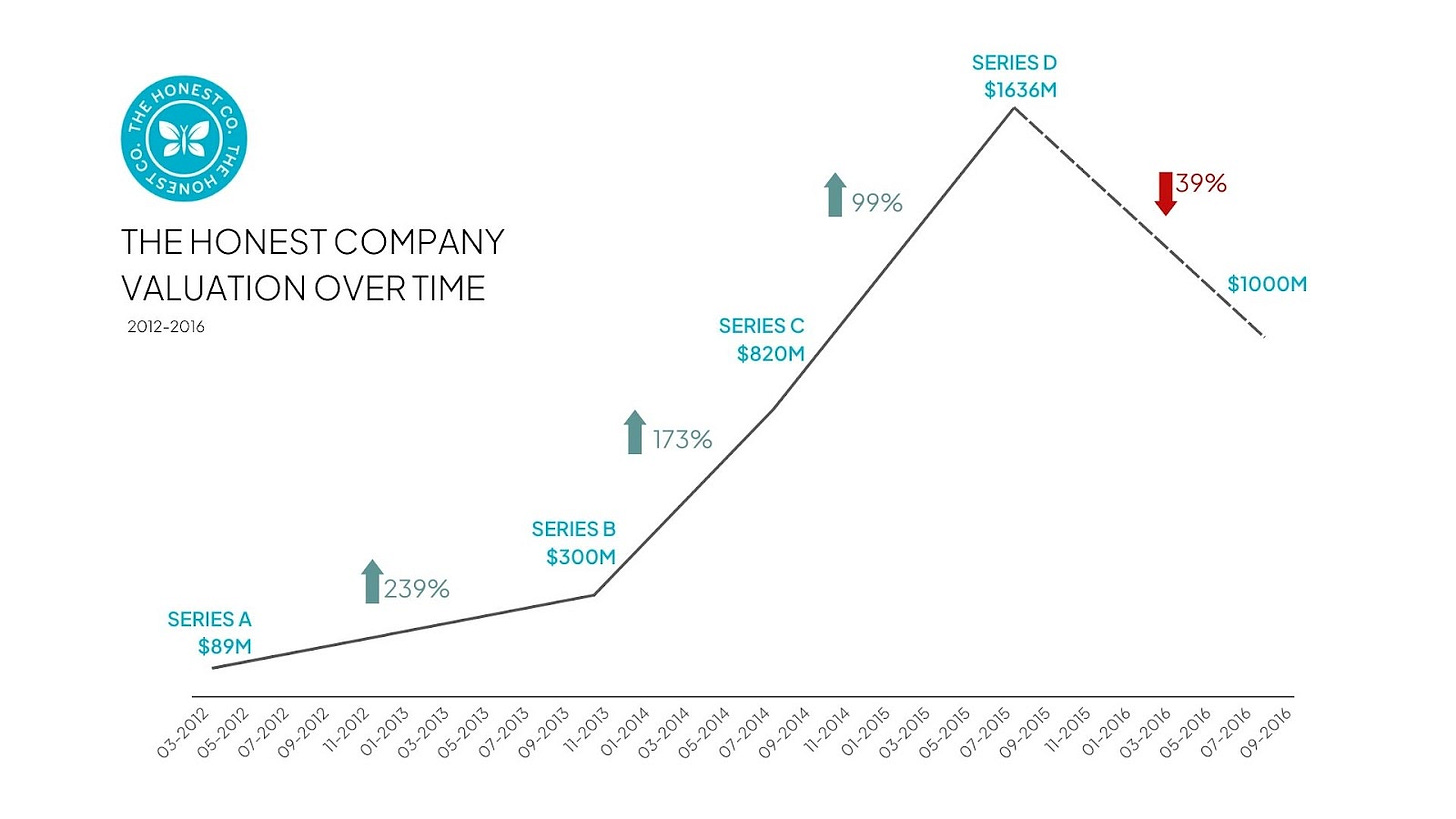

This strategy was successful as it caught the attention of General Catalyst, Lightspeed Venture, and Institutional Venture who participated in a $27M Series A in 2012. The Honest Co. launched with 17 products in the diapers and wipes category and offered a monthly subscription model as well in addition to their general e-commerce and retail stores. Running out of diapers is a nightmare for new parents and the subscription model was created based on this consumer insight. In the first year, their sales surpassed $150 million.

By 2014, the company had raised close to $128 million and expanded its product range to include soaps, kitchen cleaners, detergent, nipple balms, multivitamins, and even nursery furniture. 2015 saw them launch in Korea, with plans for further expansion.

From embracing influencer marketing, a novel concept at the time, to celebrity endorsements, The Honest Co. explored a wide range of marketing strategies

Their immediate success hinged on a combination of factors

The brand mission & responsible marketing: The brand stood firm in its foundation of creating home and kids products that were safe, affordable, and eco-friendly. This gap that they identified in the market allowed them to carve out their own niche, immediately establish a presence and provide solutions. Their vision and mission are outlined in their guiding manifesto - The Honest Standard, which elaborates on their stand when it comes to ingredients, testing, production, packaging, label transparency, and constant evolution.

This resonated with a lot of new parents who were eager to have non-toxic products for their children. Subscribing to The Honest Co.’s newsletter also included updating consumers about the latest developments at the FDA and other organizations, which served as a huge source of reassurance for new parents.

The Honest Co, was the first mover when it comes to influencer marketing. To market their products, they identified 30 influencers who fit their story and generated content, which resulted in them achieving 66% more influencer-generated content than they had intended.

Jessica Alba herself: A driving force behind the company’s public image, Jessica Alba is synonymous with the brand. She published a New York Times best-selling book titled The Honest Life, which recounts her personal journey and her road to creating this brand. She is also the face of the brand and regularly features on its YouTube channel. She represents mothers who want to choose the best for their kids and enjoys a wide loyal fan base.

How badly does a brand not following through on its promises affect them?

In 2015, after a Series D, they had a $1.7billion valuation that also came with a unicorn status. The good times were short-lived, however. In the same year, they got sued by a consumer who was reported to have suffered from severe sunburns and accused their sunscreen of containing synthetic, non-natural ingredients. Furthermore, in April 2016, a suit was filed against them by the Organic Consumers Association alleged that the Honest baby formula was falsely labeled as organic.

To add to their woes, by 2017 they had to recall a couple of their products. Their baby wipes had to be recalled due to complaints over the presence of mold. The company also had to recall its baby powder over concerns that it would cause skin or eye infections.

The bad headlines took a toll. The sales started to tail off, although they grew from $250M in 2015 to $300M in 2016. Honest was reported to have laid off 14% of its workforce by the end of 2016. Their chief financial officer and chief operating officer David Parker also left the company, and co-founder Brian Lee stepped down as CEO a few months later. He was replaced by Nick Vlahos, former chief operating officer of one of their competitors, Clorox.

The negative press also had an impact on the company's 2015 planned IPO, which did not materialize at the time. Neither did a potential sale to Unilever, which acquired their competitor Seventh Generation instead.

Rebranding and regaining consumer trust is an uphill battle

The following couple of years saw them attempting to rebrand themselves. The company focused on internal changes, bringing in in-house R&D and quality checks while upgrading and reformulating its products. Vlahos, the new CEO implemented a new strategy of ditching product lines that weren’t bringing in revenue and focusing on their significant growth drivers such as diapers, baby products, and their beauty line. “We have to drive good growth on a consistent basis, which means getting out of businesses we can’t win in,” CEO Nick Vlahos outlines.

This strategy seemed to pick up the pace, as their revenue in 2020 saw a 28% jump with diapers and wipes accounting for two-thirds of their sales. The net loss in that period also saw a decline to $14.5M from $31.1M. However, the company has never been profitable.

With declining birth rates in the US, the sales of baby care products will take a hit. “We may not be able to compete successfully in our highly competitive market,” the brand admits in its filing as part of the risk factors it faces, a standard section in IPO documents. Their IPO filing came in 2021. With a valuation of $1.44bn, they’ve been listed on NASDAQ under the symbol “HNST”. However, four trading sessions later, they fell below their IPO price. The early optimism replaced by apprehension, The Honest Co. stock, although still compelling, is considered to be an overpriced, risky bet.

The Honest Co.’s journey is a story of setting extremely high expectations, and not being able to live up to them. A brand that started off as a disruptor in the natural baby and beauty categories now sees other major players such as Johnson & Johnson, Clorox, and Unilever, all muscle their way into the all-natural segment. Although this could also be credited to its competitors' larger operating costs and infrastructural advantages, the fact remains that when it comes to consumers and brands, they are generally once bitten, twice shy. Quality is paramount, and when it comes to mission-driven products, a perceived dip in quality could have disastrous results. The Honest Co.’s road to recovery could be a long one of sustained delivery on promises, but only time will tell.