The largest online fashion company in the world: Shein

Either you have shopped from Shein atleast once in your life or have never even heard of it

Shein started as a wedding gown business

Chris Xu, founder, and CEO of Shein was an SEO specialist who worked with Nanjing Aodao Information Technology Co. He helped clients to export domestic products globally and through that, he learned of the commercial value of Chinese products on the international markets. He decided to try his own luck in the export business.

He noticed how wedding gowns were the second largest category of Chinese cross-border e-commerce due to a major price arbitrage. The average price of bridal gowns in the US was around $1166, but Xu would export them from China at merely $209 and still make a healthy profit.

After dabbling with a bunch of names for his new venture, he settled on SheInside mainly because it had good success on search page results. SheInside was off to a start in 2008.

In 2010, what started with wedding gowns expanded into broader women’s fashion. This was completely based on a dropshipping model with ZERO inventory risk. Xu would get photos from wholesalers in China and put them as it is on his website and after getting orders, place bulk orders with the wholesalers. Consumers were willing to wait longer for the steep discounts SheInside was offering.

From dropshipping to a fully-fledged fashion brand: Shein

The women’s fashion at throwaway prices picked up and Chris Xu envisioned something nobody in China could at that time: To become a global brand, not a manufacturer for global brands but a global brand itself.

Xu hired 100 designers, dropped the sourcing model, and started selling their own designs manufactured by factories in China (2013). By 2015, Chris Xu changed the brand name to Shein for easier recall.

By 2016, Shein had a team of 800 designers and marketers pumping out new styles every day.

Competition with the global fashion powerhouses

With the already established fashion powerhouses: Zara, H&M, and Uniqlo, Shein’s biggest advantage was the competitive pricing and speed. Traditional fast fashion brands would mull over consumer choices and design collections with the risk of it being a hit or miss. Shein changed the entire game by putting anything and everything out. With the help of data analytics, powerful software, and tech, they analyzed the buying patterns to tailor-make the subsequent products.

Shein adds as many styles in two months as Zara puts out in a year. During the pandemic, while the stores were shut and traditional fast fashion brands bled money, being completely online gave Shein a massive advantage where they made ~ $10B revenue in a year.

Both the brands are working on similar ethics, and have similar designs and quality but Shein is winning the race with the pricing strategy. An entire campaign burst out on Tiktok and Instagram #zaraVSShein where bloggers have shown a cheaper and alternative Shein garment for every other Zara garment out there.

Competition with the other Chinese brands

While Shein was taking off, Choies entered the market with the exact same business model and while Choies and Shein were playing in the same field, Choies fell behind as it didn’t have the software and expertise Shein had built.

“We didn’t dig deep enough or do enough research. People with SEO experience are better at this,” an executive at Choies said. Allegedly, Choies’ revenues were roughly distributed across 30% for procurement, 20% for logistics, 25–30% for advertising, and 5% for payment commission and refunds, leaving a 15–20% profit margin. In contrast, Shein’s advertising expenditure at the time was only about 15–20% of revenues, leaving a higher profit margin.”

Shein also acquired its biggest competitor back then: Romwe. Romwe was started by Xu’s friend who was also his co-founder in Shein’s predecessor company in 2008. While Romwe was giving Shein a tough competition, it didn’t have the supply chain management Shein possessed.

Shein’s initial business model required various styles but in limited quantities (less than 100 per SKU) which no factory was ready to do as quantities are where they made profits. But Shein’s timely payments earned the factories’ trust: a rare occurrence in the garment industry. In fact, when Shein moved its operations from Guangzhou to Panyu in 2015, almost all of the factories that it worked with moved there too. Everybody was fighting for Shein’s business.

CTM - Consumer to manufacturer business model

At its core, Shein has proprietary software to integrate at the factories and it was the only condition for the vendor to be eligible to manufacture for Shein. This software helped make ultra-fast fashion a reality. Shein’s software connected the factory floor to the consumer where the manufacturing plans were dynamically planned and created based on the styles that were added to the cart and browsed the most. This helped Shein in offering the wide variety of SKUs that it does but not get its money stuck in inventory. According to some reports, Shein manages to get new styles ready from design to production in 3 days (compared to its competitor Zara, which takes 3 weeks)

“Shein gets all their products shipped directly from their Chinese warehouses and since their packages are small and cheap, they remain duty-free. This way, Shein has even managed to avoid import and export taxes which is something its competitors with offline stores could never do”

Another Chinese company behind Shein’s success

Pricing and variety definitely made the conversions happen for Shein but getting traffic of 1M active daily users is not just pricing, it’s marketing. Shein was an early adopter of social media marketing, partnering with fashion bloggers for giveaways and promoting products on Facebook, Instagram, and Pinterest as far back as 2012.

With the release of Tiktok in 2016, shopping haul videos blew up on the platform, and Shein Hauls became the blogger and viewer’s favorite content.

There was a time on Twitter when the hashtag #addictedtoShein was trending.

Before they got banned in India, the top influencers and celebrities were seen endorsing Shein, attending their events, and sharing their affiliate discount codes.

In the US, the label managed to get Katy Perry, Lil Nas X, and Rita Ora for its May 2020 #SHEINTogether global streaming event.

“Shein’s early growth came in from India and Saudi Arabia, but in the past two years Brazil, Mexico, and the U.S. have been its largest markets”

The company has risen to become the most downloaded app in the US market. The app itself is very addictive and gets most of its sales from there as the interface works perfectly for its target audience: GenZ.

They have gamified the experience where you can collect points to create looks, refer people and win points for just opening the app. The customers can use these points for their next purchase. Reviews have the greatest influence on a fashion purchase, and Shein has brilliantly cracked this with their dedicated audience by rewarding them generously for publishing a photo review. This helps other users make better judgements and lowers returns and exchanges.

While the business and popularity Shein has managed to build is incredible, they have received criticism for their opaque supply chain and environmental impact. They have also been called out on various occasions for unethical practices and hurting religious sentiments but they seem to stay unfettered and continue on their path with occasional public apologies.

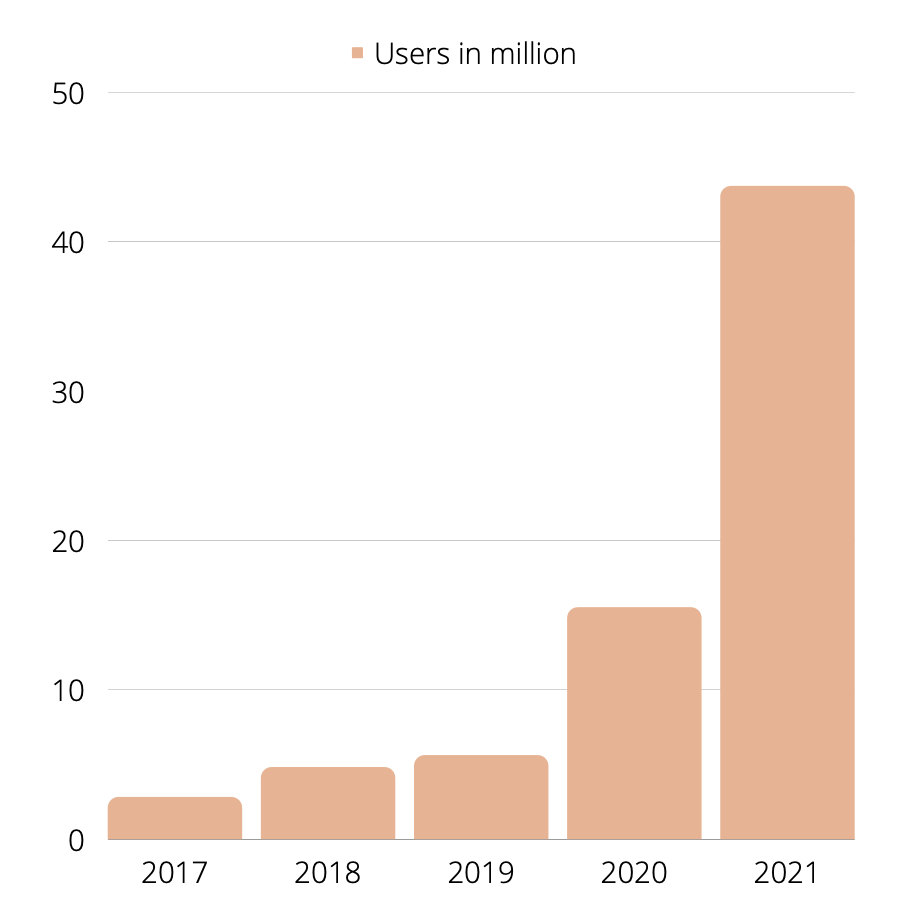

For the kind of numbers and popularity Shein has gained, it’s comparatively a very secretive brand with not a lot of information on the founder, the funding, or the processes. It is the most downloaded app in the US right now leaving even Amazon behind.